The Global Business Services Organization Design in More Detail

This paper addresses in more detail how we believe a Global Business Services organization should be structured in order to provide the best combination of cost, quality, speed and stewardship.

This paper addresses in more detail how we believe a Global Business Services organization should be structured in order to provide the best combination of cost, quality, speed and stewardship.

Background

When it comes time to actually create a Global Business Services (GBS) organization, how should it be structured? Should it be set up by Process/Service? By location? By function? We would propose a combination of these to allow the organization to deliver the best customer service possible, while also delivering the cost and stewardship benefits the company envisioned when it committed to creating a GBS organization.

The GBS Organization

As discussed in a previous paper (“The 5 Building Blocks to Creating a Successful Shared Services Organization”), we believe that in order to maximize benefits, a GBS organization should be global in scope and should include services from multiple functions, ie. Accounting, HR, Purchases, Facilities & Real Estate, etc. We also believe that because the GBS organization will have somewhat different goals than the rest of the company, and because it also needs to remain objective about what is best for the company in total, that it should be a standalone organization reporting directly to the CEO.

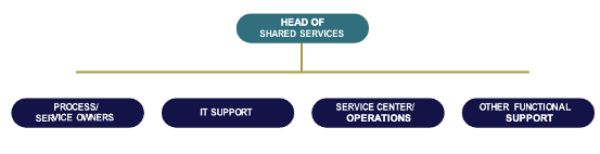

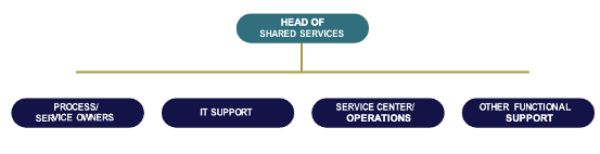

Within the GBS organization, we believe there should be 4 subgroups or reporting lines:

- The Process/Service Owners

- IT Support

- The Shared Service Centers/Operations (with a front office and a back office)

- Other Functional Support (HR, F&A, Purchases)

A simplified GBS organization structure would look as follows:

A Simplified Global Business Services Organization Structure

However, within this structure there should also be a horizontal element for each Process/ Service. For example, if one of the services was Accounts Receivable, then there would be an Accounts Receivable Process/Service Owner, an IT group within GBS supporting the Accounts Receivable service, and a group in the Service Center carrying out the Accounts Receivables daily operations. The three groups should all work together to deliver the Accounts Receivable service with excellence, and be measured against a common set of goals.

The details related to each of the 4 subgroups are as follows:

A. The Process/Service Owners

This group will work closely with the Policy Owner, the IT Support and the Shared Services Centers to develop the optimum standard global work processes. Some of the process experts from the BU’s could be good candidates to become Process Owners in the new GBS organization. But it will be important that this person maintain an open mind on ways to continue to improve and evolve their process or service. They can’t have a mindset of “that’s how we’ve always done it” or “no if it’s not invented here”.

In picking people for these roles, it is important that they are: a) experts on their business process, b) have an understanding of associated Company policy, c) are linked with the people in the Shared Service Centers who will actually carry out the work, and d) stay close on-going with the BU’s who are utilizing the service or process. The Process Owner’s mindset needs to be that of someone in a service industry with multiple customers to please, ie. Corporate is a customer from a governance standpoint, the Service Center from an efficiency and effectiveness standpoint, and the BUs from an end user/ease of use standpoint.

One point of clarification: if there are multiple functional services within the GBS group and each functional area has a large number services, then there could be multiple groups within the Process/Service Owner area. For example, there could be an HR person who is responsible for all of the HR services and has a group of HR Process/ Service Owners reporting to him/her. Similarly, there could be an Accounting person who is responsible for all of the Accounting services with multiple Accounting Process/Service Owners reporting to him/her. Each of these functional service heads would then report directly to the overall Head of the GBS organization.

B. The Shared Service Center/Operations

This group will be responsible for executing the internal work processes, which are typically more transactional in nature. While it is helpful to understand the policy and the business context of the work processes, it is not required for this group (particularly the back office group, which is discussed later in this section). The primary focus is on understanding and executing the work processes with excellence.

This is also where the bulk of the productivity improvements are going to occur. Centralizing the work into the Shared Service Centers and moving to standard best practices will allow fewer people to do the work than previously in the BU’s. There are also additional synergies by having a few people dedicated to a process vs. parts of people spread across different groups. And there is the potential to drive further efficiency by prioritizing and scheduling certain work processes to better manage peak workload periods.

We would also recommend that the operations be structured with a front office and a back office. The front office is who the BU’s would interact with when they are utilizing the service. As such, it will be important for the people in the front office to have a thorough understanding of the back office as well as understanding the business’ needs. Ideally, they would build this business knowledge by spending some time actually working in the BU’s, i.e. 3-6 months. The front office should also try to share this business knowledge with the back office to help them in prioritizing their work. Strong communications is another critical skill for the front office roles, given the different groups they will need to interact with.

The people in the back office are focused on the internal work processes or transactions. As such, it is important that their mindset be similar to someone on a production line, where they are tracking their results, scorecarding output measures, and continually looking for ways to improve in terms of quality, cost and speed.

Because the back office roles are more transactional, it allows the work to be done from almost anywhere in the world. As such, a company can choose to move this work to a low cost location, either within their home country or in another country where the population has the appropriate language skills. Moving to a low cost country can lead to even greater savings, but it also may cause challenges from a customer service standpoint. The organization needs to weigh these trade-offs when making a decision on where to locate the Service Centers/ Operations.

Also, we would recommend that fewer Shared Services Centers are better than more. The absolute minimum a company should have is one Service Center in each region to manage time differences, i.e. one for the Americas, one for Europe, Middle East and Africa, and one for Asia. Again, though, the number and location of the Service Centers depends on the language skills required and how the Service Center locations align with the BU locations from a time zone standpoint, i.e. the Service Centers need to provide coverage throughout a normal BU working day.

Finally, the work that is most transactional in nature can be outsourced, driving even further savings. For example, there are companies that specialize in entering invoices into systems, processing payroll, or even running data centers. They can often do this cheaper and better because it’s one of their core competencies. When a company is moving to a GBS structure, they should always assess which work processes could be outsourced to offer the best combination of cost, quality and speed. However, if they do outsource, there still needs to be someone within GBS who is responsible for the results of the service, and someone who is responsible for governing the outsource provider, ie. invoices need to match the services delivered, address any missed SLA’s, etc.

C. IT Support

No matter what functional work is moved to a GBS structure, there will be a need for IT support to help drive standardization, support the systems, and enable future productivity improvements. We would recommend that these IT resources be dedicated to the GBS organization (in other words, they should report up through the GBS organization). If the reporting line is outside of GBS, there is a risk that other priorities could come into play and the IT support necessary to deliver all of the services with excellence will not be available.

Another reason it is important to have the IT Support group in the GBS organization is because over time it is critical that IT develops a deep understanding of not only the systems, but also the work processes. It is through this depth of knowledge that the IT Support will be able to take on a more proactive role in identifying opportunities to improve the performance of the service, or identify opportunities to add additional value, i.e. new services or solutions that don’t exist today. As discussed earlier, we believe the best way to achieve this is for the IT Support to be organized by service within their group.

One other comment on the IT Support group: the reason this group is separate from the Process/ Service Owners is because from a technology standpoint, the IT Support group needs to drive synergies. Said differently, they need the freedom to decide what technology platforms to use to drive scale, along with how best to leverage technology to deliver resiliency and redundancy across all of the services.

D. Other Functional Support

Since the GBS group is a separate, standalone organization, it will also need other functional support, such as Finance, HR, and if there is enough outsourcing, Purchases as well. The Finance part of this organization should be centralized and will help handle all of the budgets, assist in charging out any services, and also help with forecasting and long term strategy setting. Any Finance that is part of a service that is being offered to the BU’s should be in the Service Owner area. Similarly, the Central HR group is supporting all of the other groups within the GBS organization, whereas any HR services that are being utilized by the BU’s should be under the Services section of the organization.

Summary

Once there is agreement to create a GBS organization, the next step is to decide how to structure it so it delivers excellent customer service to the BU’s while also meeting its cost and stewardship commitments. We believe that within the GBS organization there should be 4 vertical subgroups:

- The Process/Service Owners

- IT Support

- The Shared Service Centers/Operations (with a front office and a back office)

- Other Functional Support (HR, F&A, Purchases)

These 4 subgroups should all report directly to the head of the GBS organization. Each subgroup will have their own area of expertise and characteristics to look for when recruiting and training people for these areas. However, across the Process/Service Owners, IT Support and Shared Service Centers/ Operations there should also be a horizontal link for each service. For example, if one of the services is Payroll, then there will be a Process/ Service Owner for Payroll, people within the IT Support group responsible for the Payroll systems, and a group in the Service Center/Operations responsible for running Payroll. All of these horizontal owners should be measured on how well the Payroll system is delivering against its cost, quality, speed and stewardship goals.

This structure allows the horizontal owners to focus on their respective service goals, and for each of the vertical organizations to drive greater efficiency and coherence within their respective functional areas. This combination will allow GBS to deliver (and hopefully surpass) the commitments that were made when the decision was made to create the organization in the first place.

About SynFiny Advisors

We value experience. Our advisors leverage decades of Fortune 50 experience in financial planning & analysis and shared services design and operations to deliver breakthrough solutions for our clients. This collective experience has been distilled into a proprietary consulting methodology that enables our advisors to quickly apply their experience to the specific objectives of our clients, leading to faster and longer lasting value creation.

For more information, please visit synfiny.com.

ABOUT THE PRACTICE LEADER

Larry Williams

With almost 40 years of experience in supply-chain, Larry Williams is a results-focused professional who includes people, tools, technology, controls, and operations when improving existing processes or developing new processes for an organization. When working with clients, he focuses on transforming an organization using strategic sourcing practices and best-in-class procure-to- pay practices to create value.

Larry has held a variety of engineering, project management, production management, purchasing-procurement, and accounts payable positions. Through this extensive experience, he has found passion in leading companies in establishing standardized work processes. As both a visionary and a pragmatist, Larry has designed and implemented innovative programs for various companies and divisions, including shared services, risk management, policy and compliance, acquisitions and divestitures, and organization design and performance management.

Larry is a certified black belt in Lean Six Sigma and received his Associate’s degree in Mechanical Engineering from Mohawk College in Ontario, Canada.

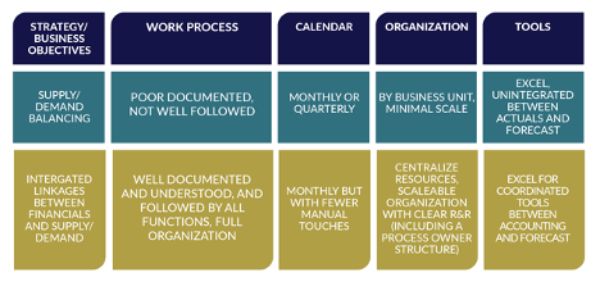

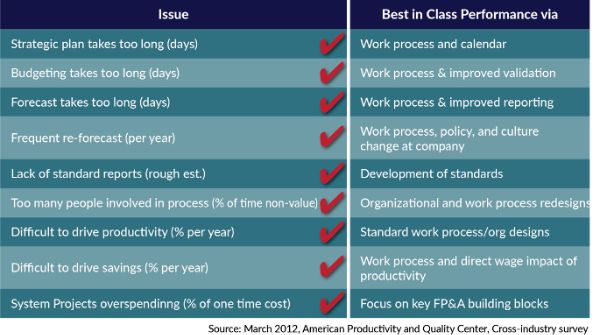

There is no company which can run systems, follow work processes, or implement policy without a fully trained and well-designed organization. Unfortunately, many times this is one of the most overlooked (after work process) areas of FP&A design.

There is no company which can run systems, follow work processes, or implement policy without a fully trained and well-designed organization. Unfortunately, many times this is one of the most overlooked (after work process) areas of FP&A design.

This paper addresses in more detail how we believe a Global Business Services organization should be structured in order to provide the best combination of cost, quality, speed and stewardship.

This paper addresses in more detail how we believe a Global Business Services organization should be structured in order to provide the best combination of cost, quality, speed and stewardship.